ORBIS - on the eve of the future

All of us, in one way or another, use bank financial products, pay a hefty interest for services, we suffer inconveniences connected with long transactions on transfer of funds, or the absence of terminals, we are credited with interest several times higher than income from deposits in the same banks. Banks say they are striving for convenience and simplicity, but these are just promotional phrases because complex and bureaucratic banking systems run by people do not allow us to come to the convenience and simplification of processes in the foreseeable future. These and other factors have shaped the situation when more than 3 billion people in the world, mainly in developing countries, do not use banking products at all and do not have a bank account.

For all this over the last decade, new technological systems of non-cash payments have appeared in the world, such as Apple Pay, Google Pay and so on. And already about 4 million people use crypto currency for payment in everyday life, it is expected that by 2030 their number will exceed 300 million. People are ripe for innovative financial decisions.

ORBIS is a coin of the future.

Traditional currency transactions are replaced by crypto-currency ones. To date, there is no universal innovative service that includes both the currency and crypto currency, therefore, to meet this need, an innovative project for transferring money and investments Orbis .

Traditional currency transactions are replaced by crypto-currency ones. To date, there is no universal innovative service that includes both the currency and crypto currency, therefore, to meet this need, an innovative project for transferring money and investments Orbis .

The ORBIS (ORBS) coin is a stable currency for making payments, saving assets and transferring without any fees, without the risk of depreciation or loss.

All users can exchange their crypto-currency or foreign currency funds directly for Orbis coins. Further, they will be able to manage their assets through a single convenient interface using the application for the smartphone Orbis Payment Mobile, barcodes and QR codes or a computer with Internet access. In the online Orbis platform, there is an integrated convenient wallet that allows customers to execute transactions easily and quickly. The Orbis project will provide an opportunity for previously non-bank individuals to become the owner of an Orbis debit card. All Orbis users will have 24/7 support in the form of AI virtual chat robots. In the future, Orbis self-service branches will provide other convenient service options.

Usually cryptocurrency platforms only produce one coin. Orbis issued two types of tokens: ORBIS Coin (ORBS) and ORBISInvest (ORBSi) . The ORBIS token is created by a limited number of 8,000,000,000,000 tokens, the price of which starts at $ 0.50. It will be used for safe transfer of funds. The ORBISInvest Token is created in a limited number of 80,000,000 tokens at a price of $ 0.50 and will be used for investment and earnings on cryptory.

ORBIS mission

The goal of the ORBIS project is to simplify the world of financial transactions for people. The mission of Orbis is to make investments, marketing, purchasing and daily transactions accessible to everyone, and also to optimize the process for those who are already participating in the decentralized network of detachments.

ORBIS technology is based on a more secure and reliable technology Blockchain 5.0, capable of performing more than 1.000.000 transactions per second, thereby competing with the largest financial companies in the world. Software technologies Orbis 5.0 allow you to safely and cost-effectively perform anonymous transactions in a worldwide decentralized network.

The goal of the ORBIS project is to simplify the world of financial transactions for people. The mission of Orbis is to make investments, marketing, purchasing and daily transactions accessible to everyone, and also to optimize the process for those who are already participating in the decentralized network of detachments.

ORBIS technology is based on a more secure and reliable technology Blockchain 5.0, capable of performing more than 1.000.000 transactions per second, thereby competing with the largest financial companies in the world. Software technologies Orbis 5.0 allow you to safely and cost-effectively perform anonymous transactions in a worldwide decentralized network.

Orbis develops the physical meaning of not all clear term token, providing more than just a digital token with virtual services that can disappear overnight. OrbisSolutions OÜ, the parent company of ORBIS Transfer, has launched an ambitious campaign to install physical branches around the world. These branches will contain Orbis ATMs for self-service, as well as provide virtual AI-based assistance on site. In the Orbis branch you will be able to perform any financial transactions and services that you used in your regular bank: payments, transfers, withdrawals, deposits and investments. Orbis offices will not have human workers. Instead, clients will be serviced by the AIs of the virtual chat robots and, eventually, even by holograms.

By 2020, Orbis aims to provide financial access for 3 million previously non-banking people in Latin America, Asia and Africa in partnership with a third party (the bank).

ORBIS: problem - solution

The ORBIS platform solves the following problems of today's financial transactions:

The ORBIS platform solves the following problems of today's financial transactions:

• Elimination of high commissions and expensive intermediary services in financial transactions;

• Reduction of waiting time - transactions should be almost instantaneous, not banking with terms up to several working days;

• Self-service and lack of physical limitations;

• No complicated documents and bureaucracy;

All these problems will be solved simply and quickly with the help of ORBIS technologies, which can be used by people of all ages without geopolitical boundaries.

Orbis Functionality

The main priorities of the ORBIS project are:

The main priorities of the ORBIS project are:

• Clients can use their own debit / credit cards on the platform for purchasing / selling transactions, or they can use the ORBIS debit card for this.

• International unlimited transfer function for calculating payments. Currency conversion - for example, between US dollars and Japanese yen.

• ORBIS will provide its customers with short-term loan loans in the form of loan applications, issuing bills between any parties that want to use this application.

• Fiat currency operations will also be possible, not just crypto-currency ones.

• Interest will be earned on your ORBIS savings accounts where tokens are stored.

• Purchase of ORBSi tokens for investment.

• ORBIS POS will allow wireless payments to become a reality for all small businesses and entrepreneurs, for example freelancers.

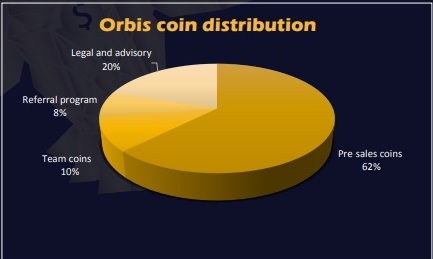

Distribution of coins:

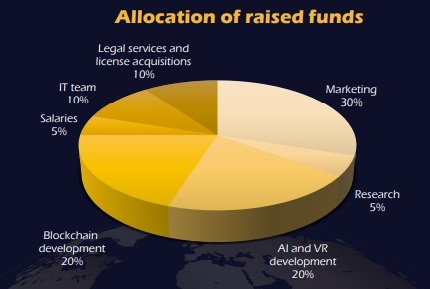

Distribution of attracted funds:

Road map

1 May 2018 - the beginning of the ICO

1 May 2018 - the beginning of the ICO

October 29, 2018 - the end of ICO

November 1, 2018: release of the version for the computer / mobile version of the platform Orbis, ORBS, ORBSi, ORBS purse and the ORBS Mobile app.

November 15, 2018: listing and trading of ORBS and ORBSi coins on most major exchanges.

December 1, 2018: issue of a debit card Orbis.

January 1, 2019: presentation of Orbis Invest.

February 1, 2019: presentation of the project "Branches of Orbis" (self-service ATMs, Virtual Reality Customer Service).

March 1, 2019: release of the Orbis franchise

October 1, 2019: presentation of Phylatropic Orbis projects

** Team Orbis **

More information about the project here:

Website: https://orbistransfer.com/

Facebook: https://web.facebook.com/OrbisToken/

Twitter: https://twitter.com/OrbisToken

Telegram: https://t.me/orbisgroup

ANN Thread link: https://bitcointalk.org/index.php?topic=3844192.0

Youtube channel: https://www.youtube.com/channel/UCRw-ywlW76rIXMY1p21U0AQ

Author by: thomas_sugiarto

Komentar

Posting Komentar